Property executives in Dubai are often asked two questions from investors seeking insight into one of the world’s most alluring real estate markets: “How fast will property prices rise?” and “Will there be another correction?”

However, if you subscribe to the wisdom of one of the world’s best investors, Warren Buffett, both questions reveal a short-term outlook that’s out of step with sensible real estate investing. In his 2014 shareholder letter, the Berkshire Hathaway chairman wrote about two real-estate deals – his purchase of a 400-acre Midwestern farm in Nebraska’s plains and of a retail property amid Manhattan’s skyscrapers – that reveal his recipe for successful property investing. Buffett’s blueprint is that instead of targeting price appreciation, investors should buy properties where they can improve income, which will boost prices in the longterm. He says smart investors should improve the property’s management to maximize recurring revenue, and he urges investors to work with expert partners. Buffett’s advice makes just as much sense in Dubai and the United Arab Emirates as it does in New York or Nebraska.

From Boom…

Not so long ago, Dubai’s property market could have used Buffett’s sage approach. Starting in 2002, Dubai enjoyed a property boom, driven by capital returning after the 9/11 attacks and further fueled by a lack of red tape and culture that encouraged creativity. When foreigners were first allowed to buy freehold-ownership property, Dubai became a global leisure destination and a regional business hub, making property hot and attracting countless speculators. It was an intoxicating mix of money and imagination. Only here could the huge amount of sand produced by expanding the port lead to the development of the iconic Palm Jumeirah, the world’s most famous manmade island with its multimillion dollar villas.

…To Doom

The seven-year long property boom ended in 2009, just as the majestically designed Burj Khalifa became the world’s tallest building. Like the views from the skyscraper’s 148th floor viewing deck, the crash was significant: Several projects were delayed or cancelled, principally reflecting liquidity shortages for developers, decreasing head line real estate prices and rental rates and increasing market uncertainty and negative sentiment amidst the global financial crisis and these factors adversely affected the real GDP growth rates in the sector in 2009 and 2010. When the crash hit, the U.S. & European capital that helped fuel Dubai’s real estate boom quickly evaporated but the government staunched the crisis with the establishment of Dubai Financial Support Fund (DFSF), a $20 billion emergency fund that was charged with supporting the strategic entities which required financial assistance with a majority being in the real estate sector. Now that prices have recovered, investors want to know what will happen next – another boom, or another bust? I expect we will experience a Goldilocks scenario, where the property market remains neither too hot or too cold.

The government as ringmaster

My outlook is buttressed by new government policies that are encouraging long-term investment and dampening speculation. The government doubled the land registration fees, charging 2 percent from both the buyer and seller to discourage flipping properties. Landlords now have the right to choose their own property management firms. And, crucially, developers selling properties based on plans must now hold a 50 percent deposit in a government-controlled escrow account that is used to pay contractors, blunting the impact of any potential bankruptcy. At DFSF, during the crisis I received offers from distress debt hedge funds to purchase developments in Dubai for at significantly lower valuations than costs. Now, thanks to the government’s strong reform policies and ability to act as the lender of last resort, those dark days are behind us, stability has returned and prices have recovered. Net profits of such developers as Emaar Properties, up 28 percent for fiscal 2016, can be viewed as a proxy for the health of the market. Foreign investment is returning too, helped by the addition of the United Arab Emirates to the Morgan Stanley Capital International Emerging Market Index. With that MSCI endorsement, commercial real estate investors are looking to invest here. Today, foreign investors can invest in freehold properties where they may own 100% of the property, or buy shares in non-freehold properties (where profits are higher) with domestic partners that control a majority of the development.

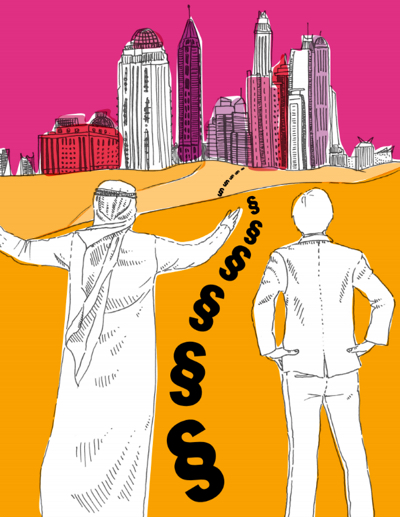

Investors Should Learn About The Region First-Hand By Coming Here To Demystify The Investment Culture.

Commercial real estate investors in freehold properties may expect 5 – 8 percent returns annually over a seven-year time horizon – a significant return in today’s low-yield environment. Non freehold properties – closer to beaches and upscale residential neighborhoods – can yield 10 – 12 percent annually over a seven-year period including capital appreciation. Demand is particularly high for certain types of developments, including residences targeted at mid-level foreign executives and their families and 3–4 star hotels that can satisfy growing conference demand. Anyone thinking of investing in Dubai should find the right local partners. And, rather than wondering how quickly an investment might be doubled, investors should learn about the region first-hand by coming here to demystify the investment culture. Investing in Dubai will likely beat any index, but investors still need to do it the right way. After all, as Buffett says, “Risk comes from not knowing what you are doing.”